New owner for leading sports surfaces specialist: Equistone funds sell Sport Group to KPS Capital Partners

Funds advised by Equistone Partners Europe ("Equistone") are selling their majority stake in Sport Group to KPS Capital Partners, LP ("KPS") following a successful partnership. With the support of Equistone, the Bavarian-headquartered group has developed into a leading international specialist for artificial turf and synthetic outdoor sports and leisure surfaces. Together with the new owner KPS, this growth trajectory is now to be continued. The transaction, the financial details of which are undisclosed, is subject to the usual regulatory approvals.

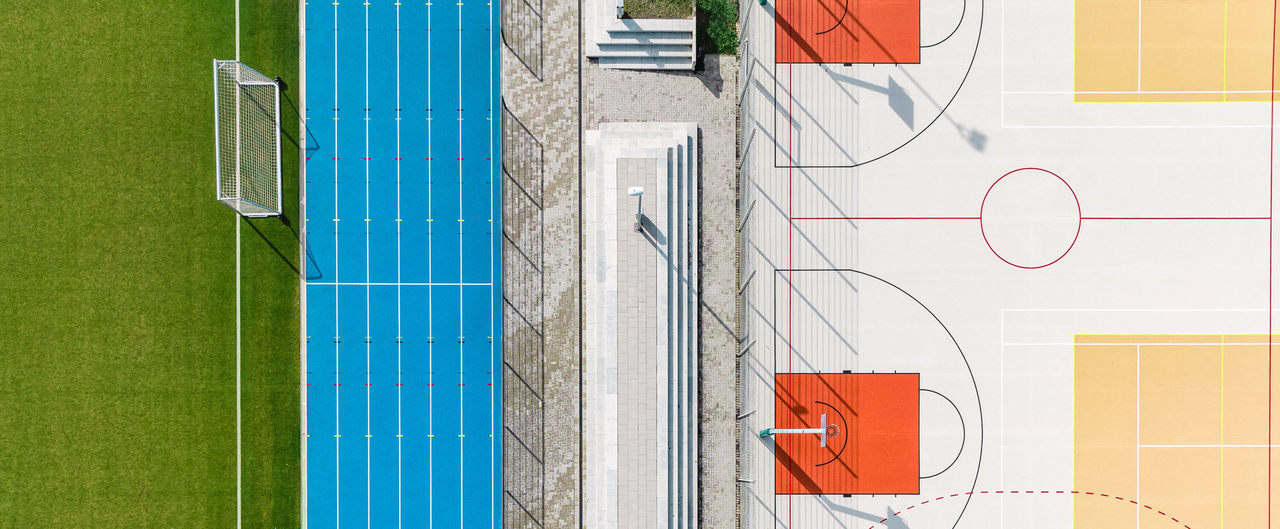

Founded in 1969, Sport Group is a global player in the manufacture of artificial turf systems and synthetic surfaces for sports and leisure with a strong presence in its home market of Germany, as well as Europe, Australia and the USA. Headquartered in Burgheim, the group provides its customers, which include prominent football clubs, sports companies and event organisers such as FC Bayern Munich, the US Open and the Olympic Games, with a comprehensive product portfolio including artificial turf, polyurethane surfaces and components for industrial and landscaping applications. A central component of Sport Group's service offering is end-to-end project support: from raw material procurement and installation to after-sales services and maintenance. With a strong focus on research and development, particularly in the area of sustainability, Sport Group has established itself as a pioneer in sustainable technologies, products and services across the industry, including through the development of the world's first carbon-neutral football and field hockey turf, as well as the first and so far only recycling plant for artificial turf and EPDM rubber. The group currently comprises 19 subsidiaries in nine countries and employs more than 1,900 people worldwide.

Equistone acquired a majority stake in Sport Group in June 2015. Since then, the company has developed its ambitious growth targets with Equistone’s support: with a total of nine successful acquisitions during the holding period, the size of the group, as well as its geographical presence within key growth markets such as Australia, USA and Malaysia, has been substantially broadened. Another important step was the continuous increase of Sport Group’s sustainability expertise: the development of sustainable products was significantly advanced with targeted investments, while this also enabled the group's profitability and professionalisation to be enhanced and adapted to increasing growth. During its partnership with Equistone, Sport Group achieved to more than double its revenues, despite a challenging economic environment due to the Covid pandemic and disrupted supply chains.

Together with the new owner KPS, Sport Group's growth is now to be taken to a new level. "The global dimension and the large number of growth opportunities in this market segment make long-term investments very attractive. Sport Group has developed extremely well over recent years. The strategic steps we have taken together with the management team have strengthened the company and helped to expand its strong position in the European market, which it already held at the beginning of our investment period, to the global landscape," explains Dr Marc Arens, Senior Partner and Country Head DACH/NL at Equistone.

Christoph von Nitzsch, CEO of Sport Group, adds: "The joint partnership with Equistone has been extremely successful - together we have been able to significantly intensify our growth in recent years and continue our international expansion. We are now looking forward to continuing on this successful course with KPS and successfully advancing our goal of setting new standards in terms of sustainability within our industry."

Responsible advisors for this transaction at Equistone Partners Europe were Dr Marc Arens, Maximilian Göppert, Moritz Treude and Mark Feiler. Equistone was advised on the transaction by Houlihan Lokey (Lead M&A), William Blair (M&A), BCG (Commercial), Deloitte (Financial), Ernst & Young (Tax & EHS), Latham (Legal), PwC (Data Analytics), Crescendo (Communications) and Goodwin (Financing).

PR Contacts

France

Paris

- Brunswick

- Agnès Catineau/Aurélia de Lapeyrouse

- Tel: +33 (0)1 53 96 83 83

- E-Mail Brunswick

GERMANY / SWITZERLAND / NETHERLANDS

Munich, Zurich, Amsterdam

- IWK Communication Partner

- Ira Wülfing / Florian Bergmann

- Tel: +49 (0)89 2000 30 30

- E-Mail IWK

UK

London

- Hawthorn Advisors

- James Davey / Daniel Thomas / Stephen Atkinson

- Tel: +44 (0)20 3745 4960

- E-Mail James Davey

- E-Mail Daniel Thomas

- E-Mail Stephen Atkinson

Birmingham

- MC2

- Amy Cantrill / Emma Gage

- Tel: +44 (0)161 236 1352

- E-Mail Amy Cantrill

- E-Mail Emma Gage

Manchester

- MC2

- Liam Buckley

- Tel: +44 (0)161 236 1352

- E-Mail Liam Buckley